Why Budget 2026 Feels Unusually Quiet: Big Tax Reforms Are Already Behind Us

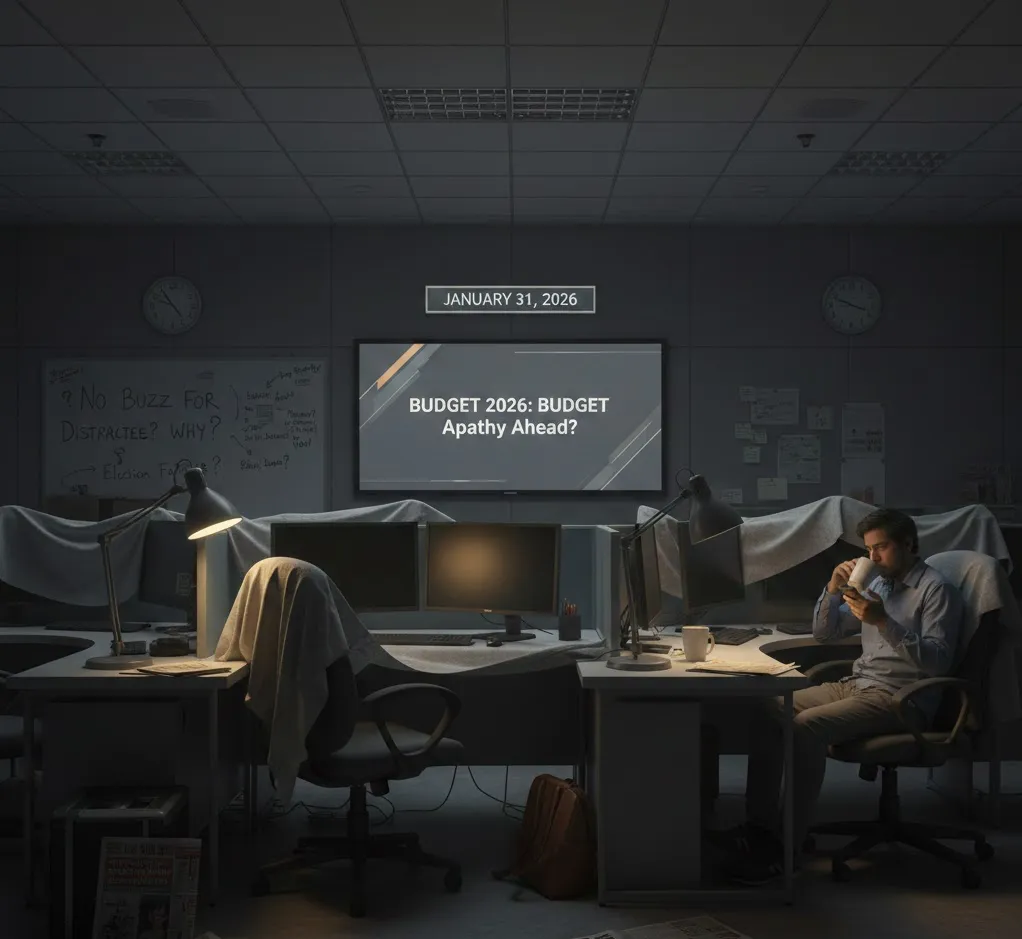

In most years, the weeks leading up to the Union Budget are marked by intense public debate, market speculation and widespread expectations of tax relief. However, Budget 2026 is unfolding in an unusually calm environment, with little buzz among taxpayers and households. This subdued sentiment is not accidental. It reflects the reality that the government has already delivered some of the most significant taxpayer-friendly reforms in recent years through Budget 2025.

Last year’s Budget fundamentally reshaped personal income taxation by removing tax liability on income up to approximately ₹12.75 lakh under the new tax regime, alongside revised slabs and a higher standard deduction. For millions of salaried individuals and middle-class families, this was a landmark change that substantially improved disposable incomes. Given the scale of that reform, economists and policy experts agree that another major overhaul in personal income tax is unlikely so soon, which has dampened pre-Budget speculation.

Indirect taxation has followed a similar trajectory. The GST restructuring announced in 2025 simplified multiple slabs and lowered rates across a wide range of consumer goods. Households are still absorbing the benefits of these changes, from reduced prices on daily essentials to electronics. With a major GST reset already underway, expectations of further immediate changes are minimal.

Macroeconomic conditions also explain the lack of urgency. Inflation has remained largely within the Reserve Bank of India’s target band, with food and core inflation showing stability despite minor fluctuations in recent months. When inflation is not straining household budgets, the demand for dramatic fiscal relief naturally weakens. According to the Economic Survey 2025–26, India’s real GDP growth is projected at 6.8–7.2% for FY27, a moderation from the previous year but still among the strongest growth rates globally.

At the same time, global developments are reshaping policy priorities. Higher tariffs imposed by the United States on select Indian export categories, including textiles and engineering goods, have created pressure on exporters. While India’s diversified trade base and new trade agreements have helped cushion the impact, strengthening export competitiveness, logistics and manufacturing resilience is emerging as a key concern.

Against this backdrop, Budget 2026 is expected to focus on consolidation rather than disruption. Analysts anticipate continued emphasis on capital expenditure, infrastructure development, education, skilling, healthcare and technology—sectors that support long-term productivity and economic resilience but do not immediately affect household budgets. Export-oriented industries and MSMEs are likely to seek targeted support, while consumers should not expect headline-grabbing tax announcements.

The absence of buzz around Budget 2026 reflects a period of economic stability rather than policy inertia. With major consumer-facing reforms already delivered, inflation under control and growth steady, the government appears set to prioritise sustaining momentum over unveiling dramatic surprises.