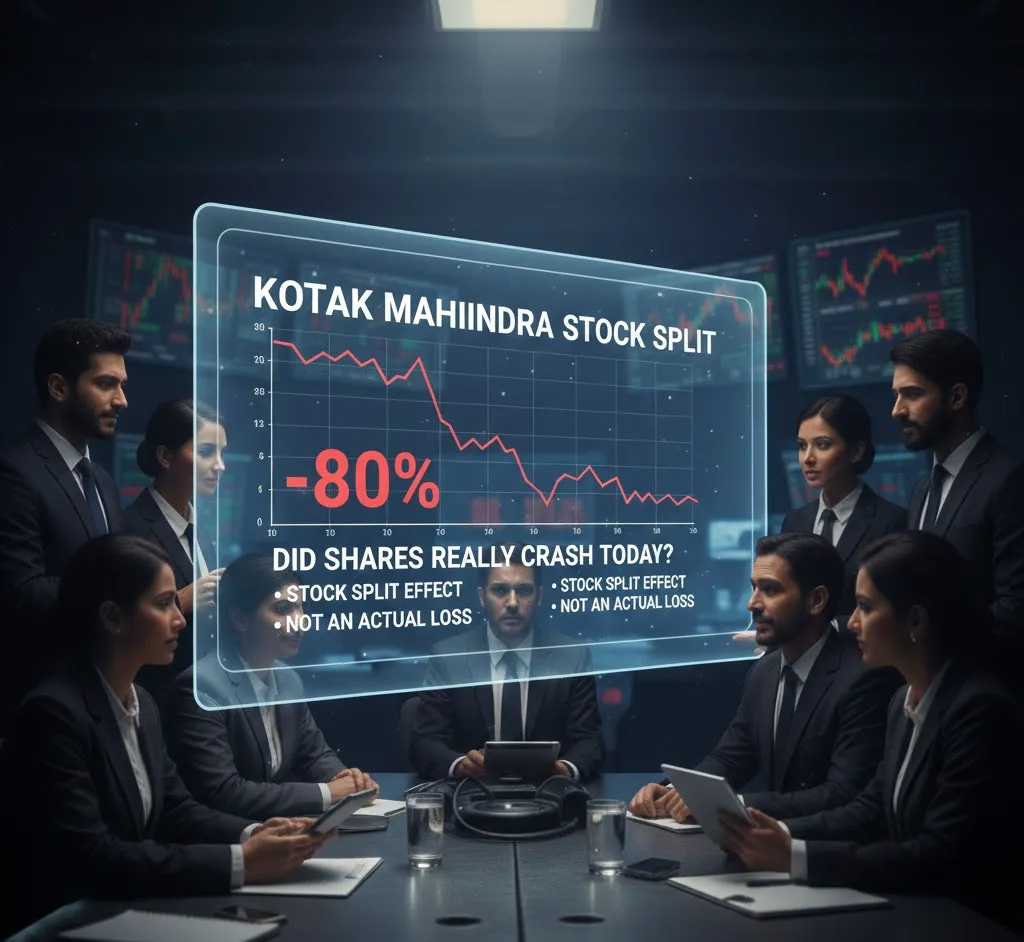

Kotak Mahindra Stock Split: Did the Private Lender’s Shares Really Fall 80% Today?

Shares of Kotak Mahindra Bank appeared to plunge sharply in early trade on Wednesday, falling over 80% to touch a day’s low of Rs 425.05 on the BSE.

At first glance, the move caused concern among investors, but the steep drop was not related to any issue with the bank’s business or financial health. The fall was purely a technical adjustment due to the bank’s 5:1 stock split, which came into effect today.

WHY THE STOCK APPEARED TO FALL 80%

As part of the corporate action, Kotak Mahindra Bank subdivided each equity share with a face value of Rs 5 into five equity shares of Re 1 each. Consequently, the market price adjusted to roughly one-fifth of its previous level.

On several trading platforms, particularly those that do not automatically adjust historical prices for splits, the shares appeared to have dropped nearly 80%. This decline was only optical, resulting from the mathematical adjustment rather than investor selling.

Before the split, shares traded above Rs 2,100. After the 5:1 split, the adjusted price is around Rs 420. Taking this into account, the stock was actually down only about 1.6% during the session, a normal market fluctuation. On a split-adjusted basis, the stock continues to trade within its recent range, with a 52-week low of Rs 346 and a high of Rs 460. The bank’s market capitalization, adjusted for the split, stands at approximately Rs 83,500 crore, and the stock is still up more than 9% over the past year.

WHAT THE STOCK SPLIT MEANS FOR INVESTORS

For existing shareholders, the split does not change the total value of their investment. Only the number of shares held and the price per share are adjusted.

For example, one share held before the split now becomes five shares in the demat account, with the price of each share reduced to roughly one-fifth of the earlier price. Investors do not need to take any action, as the additional shares are credited automatically.

Stock splits are primarily intended to improve liquidity and make shares more affordable for retail investors. They do not impact the bank’s business performance or long-term prospects.

KOTAK MAHINDRA BANK’S STOCK SPLIT HISTORY

This is not the bank’s first split. On September 13, 2010, the face value of shares was reduced from Rs 10 to Rs 5 in a 2:1 split. The latest 5:1 split, effective January 14, 2026, reduces the face value from Rs 5 to Re 1, again aimed at boosting trading volumes and broadening participation.

BROKERAGE VIEWS

Brokerages continue to focus on the bank’s medium-term fundamentals rather than today’s split. An HDFC Securities report this week maintained a positive outlook, highlighting steady growth, strong deposit quality, and stable profitability. The brokerage reiterated a ‘Buy’ rating with a pre-split target price of Rs 2,500, reflecting confidence in the bank’s long-term strength despite sector-wide challenges.

In short: Kotak Mahindra Bank shares did not really crash 80% today. The apparent fall on screens was a technical adjustment due to the stock split, not a sign of any negative development at the bank.