8th Pay Commission Likely in FY27: Salary, Pension Hike to Boost Consumption

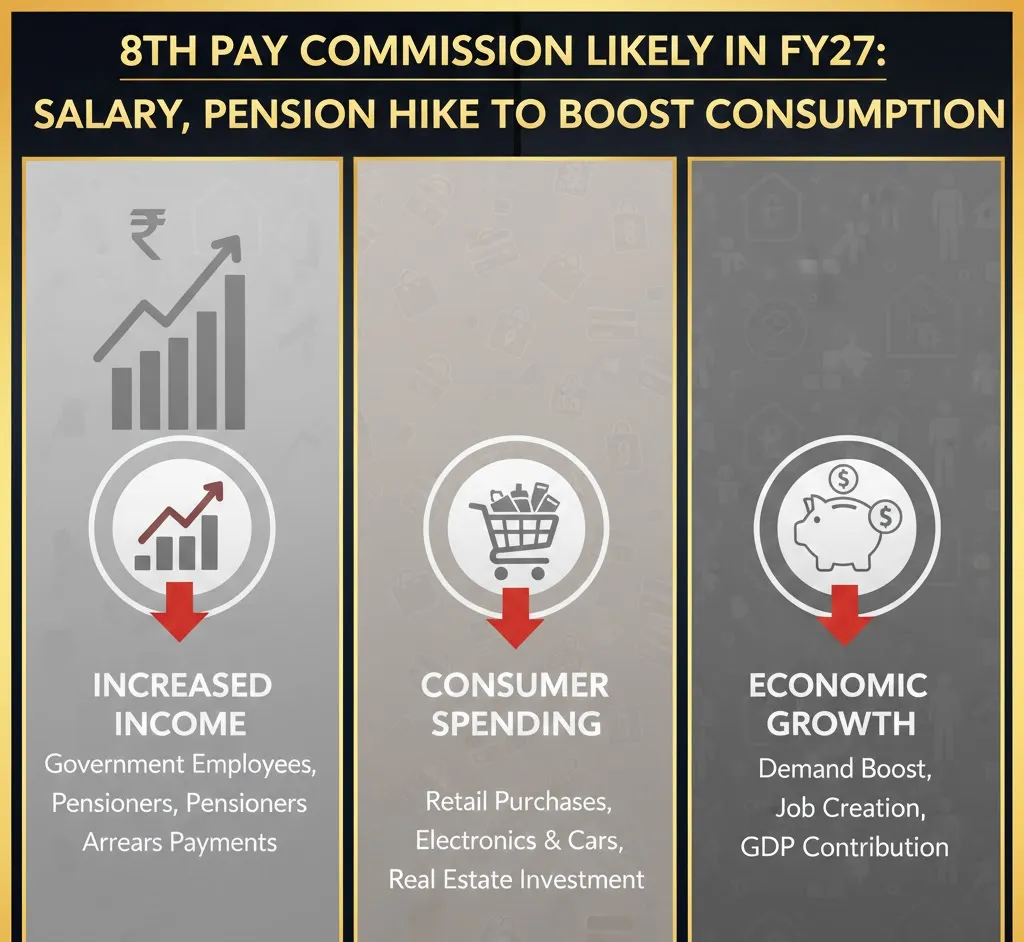

The proposed 8th Pay Commission, which will replace the 7th Central Pay Commission implemented in 2016, is expected to play a crucial role in reshaping the salaries, allowances, pensions, and retirement benefits of central government employees. According to Ambit Institutional Equities, the new Pay Commission is likely to be implemented in FY27 and could lead to a sharp 30–34% increase in salaries and pensions.

The revision is expected to directly benefit around 4.4 million central government employees and nearly 6.8 million pensioners, taking the total number of beneficiaries to more than 11 million. While annual dearness allowance adjustments protect against inflation, a Pay Commission provides a once-in-a-decade reset aimed at keeping government pay competitive with the private sector and improving talent retention.

Ambit estimates the additional fiscal cost to the Centre at around Rs 1.8 trillion. State governments are also expected to follow the Centre’s lead, potentially increasing their expenditure by at least 0.5% of GSDP. The higher payouts, combined with tax cuts announced in the FY26 Budget, are likely to support consumption demand in the economy.

Although revised pay scales may take effect from January 2026, actual payments could be delayed if the formation or approval of the Commission is pushed back. In such a case, employees may receive arrears later. Experts say arrears are likely to be calculated from January 1, 2026, the official end date of the 7th Pay Commission.

While central government employees and armed forces personnel account for just about 0.7% of India’s total workforce, economists believe the indirect impact of higher disposable income could have a broader ripple effect on consumption, savings, and overall economic growth.