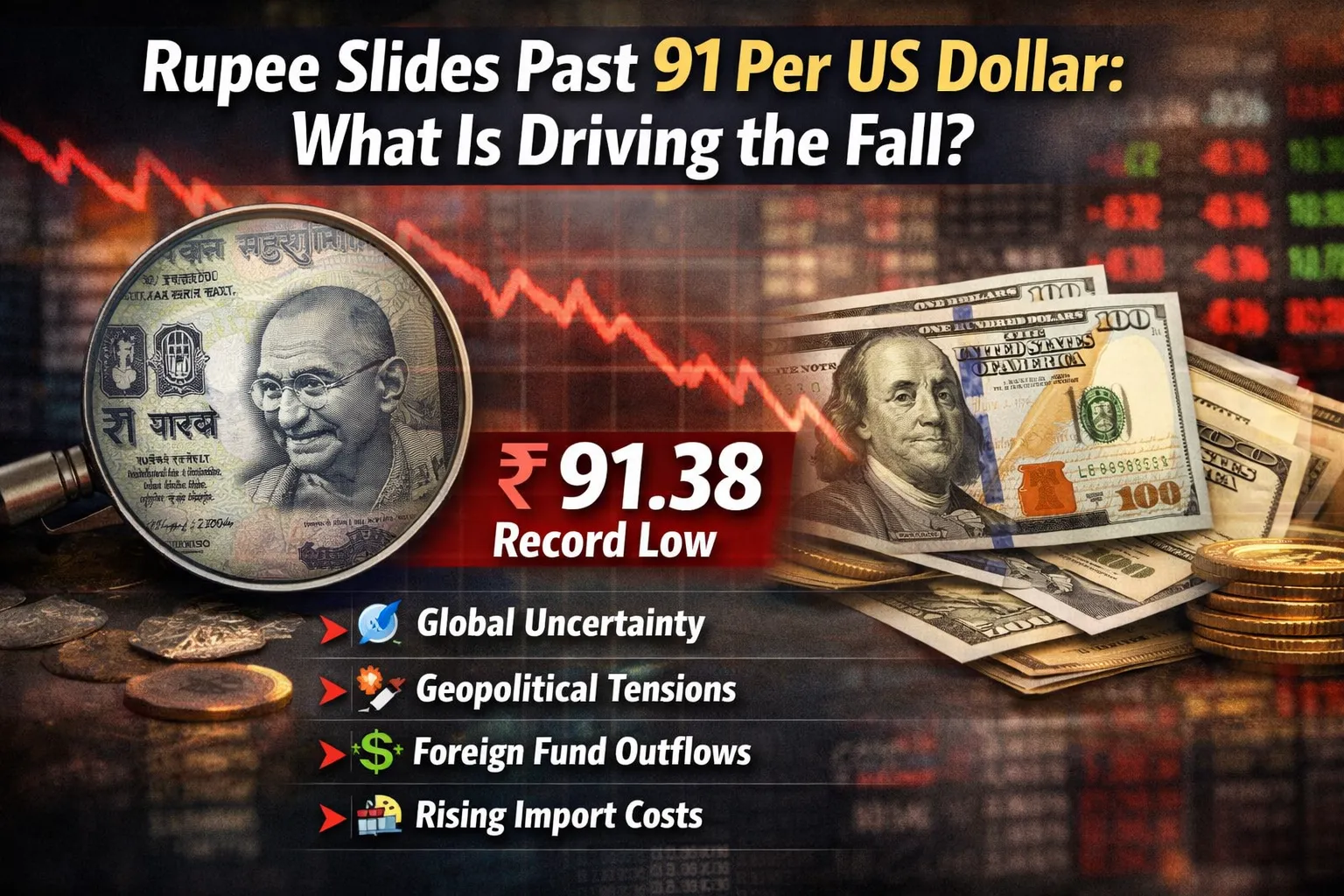

“Rupee Dips Below 91 Against US Dollar: Key Factors Behind the Slide”

The Indian rupee fell sharply past the 91-per-dollar mark, hitting record lows amid rising global uncertainty and a strengthening US dollar. Geopolitical tensions, renewed trade concerns, and persistent foreign investor outflows have intensified pressure on the currency.

Strong dollar demand from importers and continued foreign institutional selling have further weakened the rupee. The Reserve Bank of India (RBI) has adopted a measured approach, allowing gradual depreciation while intervening occasionally to prevent disorderly volatility.

A weaker rupee impacts import costs, inflation, overseas travel, and foreign education, while benefiting exporters through improved foreign earnings. Moving forward, the rupee’s trajectory will depend on global risk appetite, trade developments, and investor flows, with potential for continued volatility in both currency and equity markets.