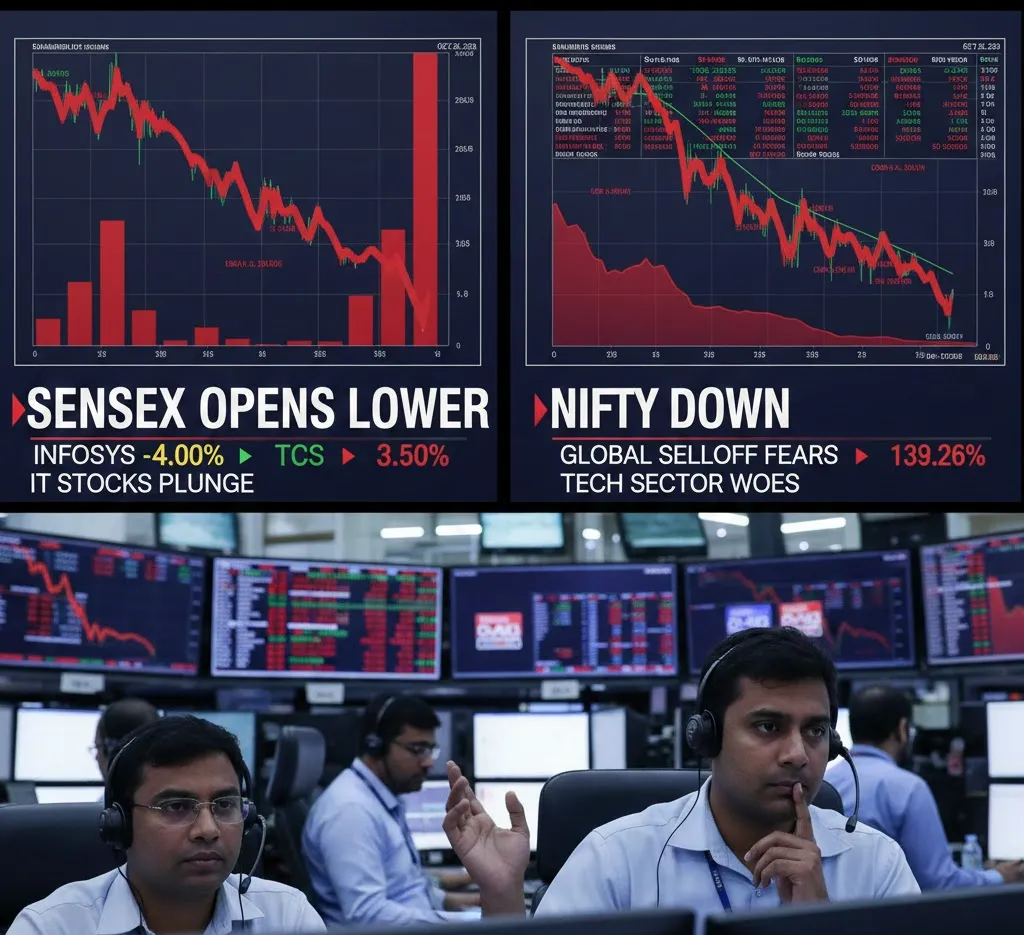

Sensex, Nifty Open Lower as IT Stocks Slide; Rate Cut Hopes Fade After US Jobs Data

Benchmark stock market indices opened lower on Friday, pausing their recent rally as a sharp sell-off in IT stocks weighed on sentiment. The weakness mirrored global technology losses following strong US economic data that dampened expectations of near-term rate cuts.

The S&P BSE Sensex declined 360.77 points to 83,872.87, while the NSE Nifty50 fell 99.70 points to 25,854.15 in early trade.

US Jobs Data Impacts Sentiment

According to Dr. VK Vijayakumar, Chief Investment Strategist at Geojit Investments Limited, the addition of 1,30,000 jobs in the US last month and a drop in unemployment to 4.3% suggest that the US Federal Reserve may not cut interest rates anytime soon. Higher-for-longer interest rates typically put pressure on growth stocks, especially technology companies.

He added that in India too, the rate-cutting cycle appears to be nearing its end, as economic growth remains strong and inflation is expected to move closer to the RBI’s long-term target by the end of FY27.

IT Stocks Lead the Fall

Information technology heavyweights such as Infosys, TCS, and Wipro fell up to 5% in early trade. Other major IT stocks including HCLTech and Tech Mahindra also declined sharply. The Nifty IT Index plunged nearly 5%, making it one of the worst-performing sectoral indices of the day.

Vijayakumar noted that tech stocks, still reeling under the “Anthropic shock” related to rapid AI advancements, are unlikely to recover soon. He highlighted the sharp dip in ADRs of leading Indian IT firms in the US as an indication of continued pressure on the sector.

Gainers Provide Some Cushion

Despite the IT-led sell-off, some stocks offered support to the broader market. State Bank of India led the Sensex gainers, rising 1.23%, followed by ICICI Bank at 1.18%. Bharat Electronics gained 0.83%, Tata Steel rose 0.75%, and Bajaj Finance advanced 0.74%.

On the losing side, Infosys dropped 4.46%, Tech Mahindra fell 3.95%, TCS declined 3.64%, HCL Technologies slipped 3.25%, and Eternal Ltd was down 1.55%.

Earnings Growth and FII Flows in Focus

Vijayakumar emphasized that market support will likely come from earnings growth rather than liquidity alone. Sectors such as automobiles, jewellery, hotels, select capital goods, telecom, and financials are showing strong earnings momentum and could continue to outperform.

He pointed out that stocks like Eicher Motors, Titan, and Apollo Hospitals have seen sharp gains following better-than-expected results, indicating that markets are rewarding strong performance.

Importantly, foreign institutional investors (FIIs) have turned net buyers in six of the last seven trading sessions, signaling that sustained selling pressure may have ended. According to Vijayakumar, while occasional profit-booking may occur, the broader undertone of the market remains resilient. In the near term, indices are likely to consolidate around current levels with a mild upward bias.