Speaking at theDetroit Economic Clubduring a visit to Michigan, Trump argued that strong economic and market performance should prompt the US central bank to lower borrowing costs rather than keep policy tight.

“If you announce great numbers, they raise interest rates. When the market goes up, they should lower rates,” Trump said.

Moments later, he escalated his remarks personally against Powell, saying mortgage rates were falling “not with the help of the Fed” and adding,“If I had the help of the Fed, it would be easier — but that jerk will be gone soon.”

Long-running Trump–Fed clash

Trump has repeatedly criticised the Federal Reserve’s rate strategy, pressing for aggressive cuts to stimulate manufacturing, investment and consumer spending. He argues that lower interest rates would turbocharge growth and ease pressure on households, while the Fed has maintained that policy decisions must prioritise inflation control and employment stability.

The remarks came as Trump toured aFord plant in Dearborn, highlighting his administration’s manufacturing push and addressing concerns over job growth.

Earlier in the day, Trump accused Powell of being either “incompetent” or “crooked,” referring to cost overruns linked to renovations at the Federal Reserve’s Washington headquarters — an issue now under scrutiny by theUS Justice Department.

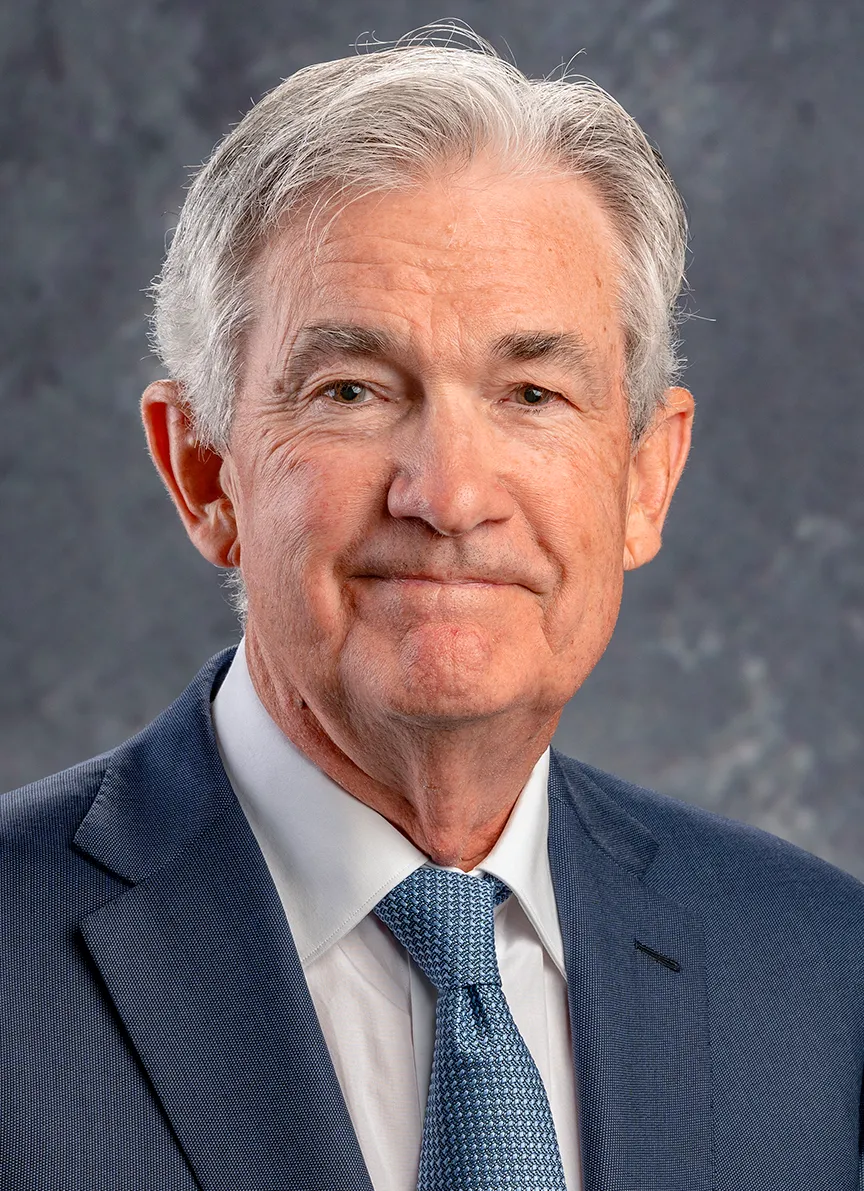

Powell pushes back amid DOJ probe

Powell confirmed on Sunday that the Justice Department has opened a criminal investigation related to his past Senate testimony on the Fed’s building renovations. In a video statement, he suggested the probe must be viewed in the context of political pressure from the White House.

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best judgment of what serves the public, rather than following the president’s preferences,” Powell said.

He added, “No one — certainly not the chair of the Federal Reserve — is above the law. But this unprecedented step must be seen in the broader context of sustained pressure.”

What comes next

Powell is due to step down as Fed chair inMay 2026, and Trump is expected to announce his successor by the end of the month. With interest rates, inflation and central bank independence now firmly in the political spotlight, the confrontation underscores a deepening rift between the White House and the US monetary authority.