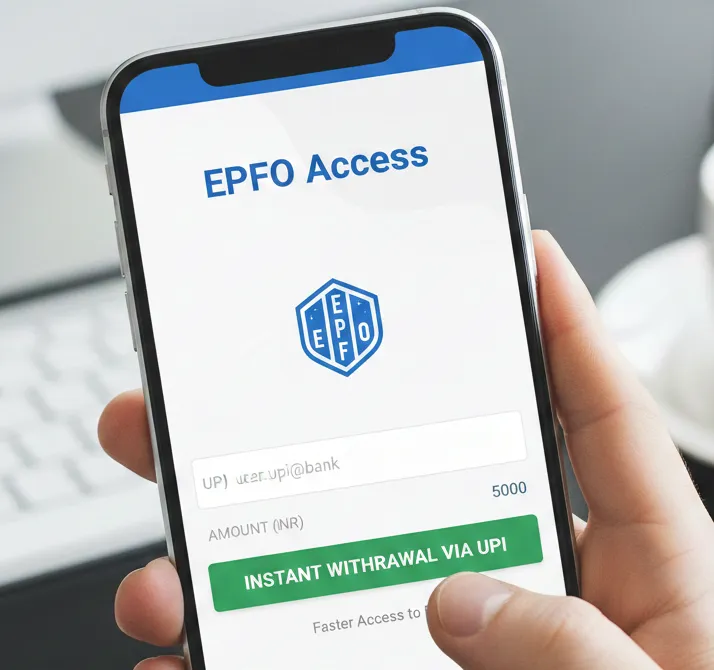

EPFO to Launch Dedicated App; PF Withdrawals via UPI Likely by March-End.

The Centre is set to introduce a dedicated mobile application for the Employees’ Provident Fund Organisation (EPFO) by the end of March, allowing subscribers to withdraw their provident fund (PF) savings through the Unified Payments Interface (UPI), according to senior officials aware of the development.

The upcoming EPFO app will function independently of the existing UMANG platform and aims to provide a more streamlined, user-friendly interface for subscribers. The application will be linked to users’ bank accounts and integrated with BHIM as well as other UPI-enabled apps, enabling seamless fund transfers.

Once the app becomes operational, EPFO subscribers will be able to transfer money directly from their EPF accounts to their registered bank accounts and withdraw the amount using UPI. Currently, EPFO members can apply for PF withdrawals only through the Universal Account Number (UAN) portal, as there is no UPI-based withdrawal facility in place.

Officials said testing of the new application has been completed, clearing the way for its rollout by March-end. Under the proposed system, subscribers will be allowed to withdraw up to 75 per cent of their EPF balance, provided that at least 25 per cent of the corpus remains in the account, in line with existing rules.

In cases of unemployment, the remaining 25 per cent of the balance can be withdrawn after a period of 12 months.

At present, the EPFO has nearly 300 million registered subscribers, including around 7.5 crore active contributing members. The total EPFO corpus is estimated to be close to Rs 26 lakh crore.

The introduction of UPI-enabled PF withdrawals is expected to significantly simplify and speed up access to provident fund savings, offering greater convenience to millions of subscribers across the country.