Budget 2026: Insurance Industry Seeks Tax Relief, Regulatory Clarity, and Wider Coverage

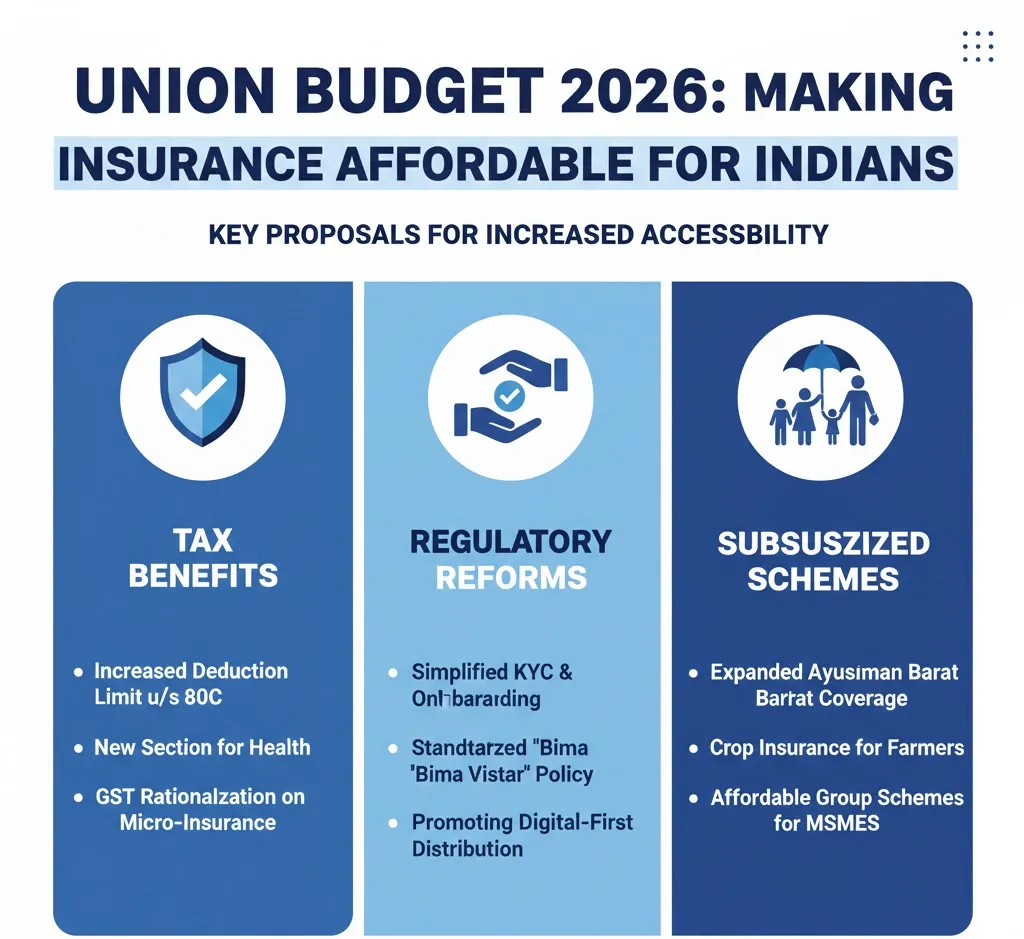

As the Union Budget 2026 approaches, leaders from India’s insurance sector are urging the government to prioritise long-term structural reforms over short-term incentives. With healthcare costs rising and insurance penetration still uneven, industry experts believe the budget can play a decisive role in improving financial protection for Indian households.

Executives highlight the importance of policy continuity and regulatory clarity to sustain growth and build consumer confidence. Abhishek Bansal, Chief Revenue Officer at InsuranceDekho, said recent GST reforms have helped improve affordability, but the next phase must focus on stable regulations, balanced taxation of pensions and annuities, and clearer norms on composite licensing. He also stressed the need to strengthen micro-insurance to expand coverage in rural areas and smaller towns.

Health insurance remains a key concern. Rajendra Upadhyaya, Chief Growth Officer at Choice Insurance Broking, pointed out that while reforms such as zero GST on individual premiums and higher FDI limits have boosted the sector, existing tax deductions under Section 80D have not kept pace with medical inflation. He urged the government to revise tax limits to reflect current healthcare costs, making adequate health cover more affordable for families and senior citizens.

Life insurers are also seeking policy measures to encourage long-term savings and close India’s life protection gap. Sumit Madan, MD and CEO of Axis Max Life Insurance, said higher and simpler tax incentives under Sections 80C, 80CCC and 80CCD could revive insurance adoption. He also proposed a separate tax deduction for pure term insurance to improve life cover and strengthen household financial security.

Overall, industry expectations from Budget 2026 converge on a single objective: making insurance affordable, accessible and relevant for all. Experts believe realistic tax benefits, regulatory stability and a long-term policy vision can accelerate India’s progress toward the goal of “Insurance for All by 2047.”