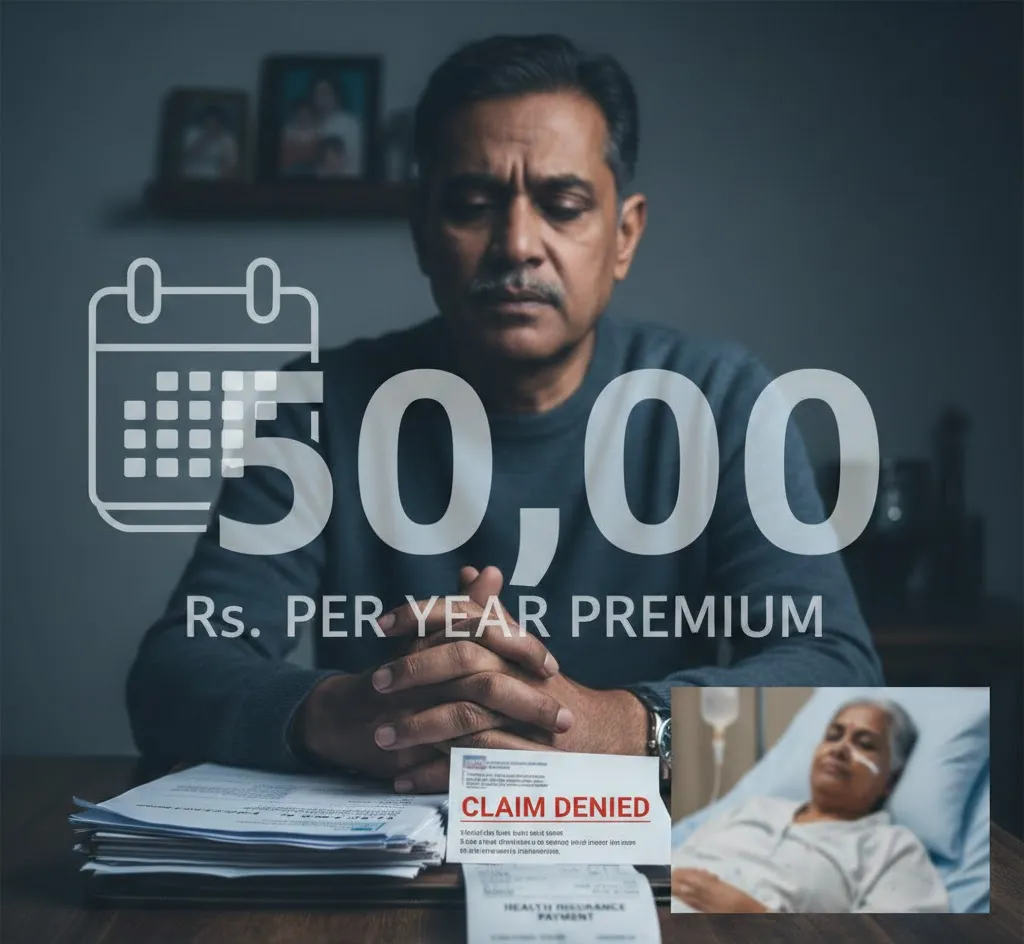

Premium Paid, Claim Denied: Viral Post Sparks Debate Over Health Insurance Trust in India

A viral social media post has triggered nationwide discussion about the gap between paying health insurance premiums and actually receiving claim support during a medical emergency. The post describes a man who had been paying approximately Rs 50,000 annually to keep his mother’s health insurance policy active. However, when she required treatment, he alleged that his claim was denied after hours of waiting at the insurer’s Lucknow office.

The insurer involved, Star Health and Allied Insurance, responded publicly, stating that claim decisions are based strictly on documented disclosures and verified medical records. The company cited “material non-disclosure” as a legitimate reason for claim rejection under policy contracts and regulatory norms. However, it did not address the specific allegations regarding office conduct or the reported remark made by an agent.

The issue highlights a broader concern in India’s growing health insurance sector — the difference between verbal disclosures made to agents and the information formally recorded in policy documents. In many disputes, customers claim they shared full medical histories verbally, only to later discover that omissions in paperwork became grounds for rejection during claim verification.

The situation has sparked public outrage online, with many users sharing similar experiences and expressing fear about whether their own long-term premium payments would translate into financial protection when needed. Some have called for stronger regulatory oversight and intervention.

Health insurance operates on a contractual framework where full and accurate disclosure is essential. Yet, for families facing medical crises, technical clauses often feel secondary to the expectation of support. Paying premiums is a routine financial commitment; filing a claim typically happens during emotional and financial distress.

Policyholders whose claims are rejected can seek written explanations, file internal grievances with the insurer, escalate matters to the Insurance Ombudsman, or approach the regulator’s grievance redressal system. While many disputes are resolved at later stages, the process can be lengthy and stressful.

The viral episode reflects a deeper tension in India’s insurance ecosystem: insurers emphasize risk management and fraud prevention, while customers seek reliability and reassurance. For many families, the central question remains — does paying premiums guarantee protection, or does the real challenge begin at the time of claim?