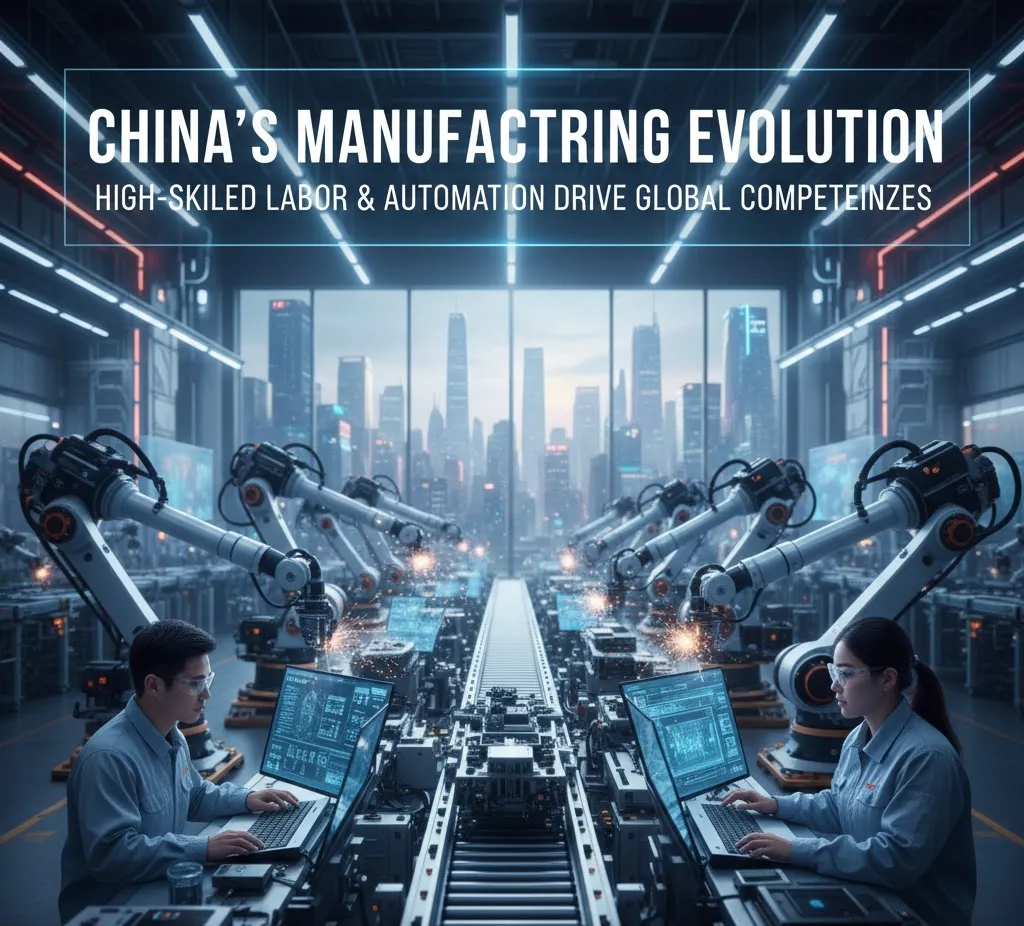

Rising Costs, But Still Dominant: How China Retains Its Manufacturing Lead

China’s rise as the world’s manufacturing powerhouse was long fueled by cheap labor, but rising wages over the past three decades—reaching around$8 per hour by 2022—have shifted the dynamics. Despite higher costs than competitors like Vietnam ($2.3), Malaysia ($2.1), Thailand ($1.9), and India ($1.1), China remains thelargest manufacturing hub, producing$4.66 trillion in goods in 2024, nearly28% of global output.

The reason is not cheap labor, butproductivity and scale. Chinese factories produce more per worker, maintain higher quality, and execute faster than low-cost alternatives. The country’send-to-end manufacturing ecosystem—comprising industrial clusters, supplier networks, logistics, skilled labor, and advanced technology—minimizes delays and costs, making relocation costly and complex for global firms.

China also benefits frombusiness-friendly reforms, advanced automation, digital infrastructure, and a massive domestic market, allowing firms to design, prototype, and mass-produce products rapidly. While challenges likeIP protection, rising wages, and regulatory hurdlesexist, the country’s productivity, speed, and integrated industrial system keep it at the center of global manufacturing.

In short, China’s dominance is no longer about cheap labor—it is aboutefficiency, scale, and an unrivaled industrial ecosystemthat other countries cannot easily replicate.