Global Markets Jolt as Trump Threatens Greenland Tariffs, Dollar Weakens

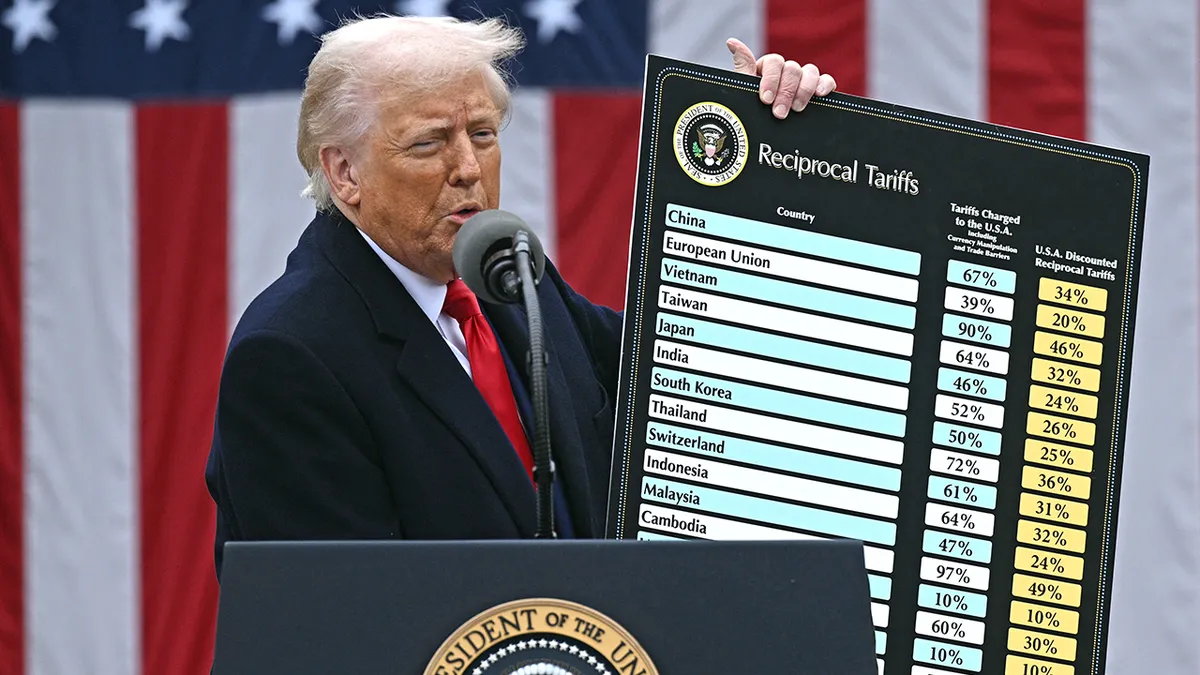

Global markets turned cautious after US President Donald Trump threatened fresh tariffs on eight European countries, linking the move to their refusal to negotiate over his proposal to buy Greenland. The announcement quickly dented investor sentiment, triggering a shift towards safe-haven assets and putting pressure on the US dollar.

Trump said the US would impose a 10% tariff from February 1 on imports from Denmark, Norway, Sweden, Finland, Germany, France, the Netherlands and the UK, with duties set to rise to 25% from June 1. The unusual connection to Greenland has unsettled European leaders, who described the threat as destabilising and warned that retaliation is likely if the tariffs are implemented.

Global equities softened as investors reduced exposure to riskier assets. Asian and European markets opened lower, while US futures pointed to a cautious start. The dollar weakened as traders moved into traditional safe-haven currencies such as the Japanese yen and the Swiss franc, while gold attracted fresh buying interest amid rising uncertainty.

Market participants are concerned that renewed trade tensions between the US and Europe could disrupt global supply chains, raise import costs and further strain an already fragile global growth outlook. The unpredictability of tying tariffs to a geopolitical demand has added a new layer of risk, increasing fears of prolonged volatility.

European governments have rejected the Greenland-linked pressure tactic and are preparing response options should the US proceed. Any countermeasures or coordinated EU action could deepen market swings in the coming weeks.

With key tariff deadlines approaching, investors are closely watching developments in Washington and Brussels. Until there is clarity on whether the US follows through or retreats, global markets are expected to remain volatile, with the dollar likely to stay under pressure as policy uncertainty persists.